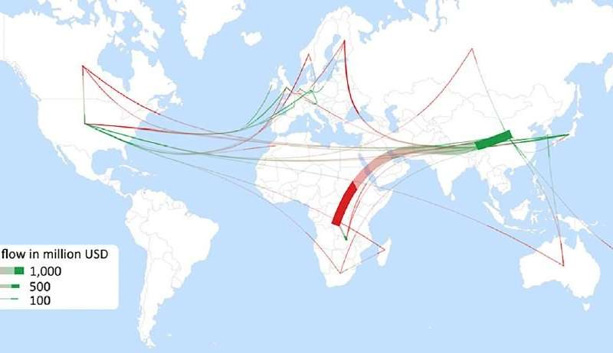

This map shows the global aggregated trade flows of cobalt ores, concentrates, mattes, and other intermediate products of cobalt metallurgy, including waste and scrap for the year 2015. Flows below 10 million USD are not included. Credit: Olivetti et al./Joule 2017

The key materials that make up lithium-ion batteries, including manganese, nickel, and graphite, likely have sufficient supply to meet the anticipated long-term growth in demand for electric vehicles and portable electronics if we start planning now, say researchers in a perspective published October 11 in the journal Joule. Their first-of-its-kind analysis of the lithium-ion battery supply chain identified short-term challenges for obtaining lithium and cobalt, which may be mitigated by market responses, and the potential development of new cathode materials to replace cobalt.

“The theme that we see with material availability is there’s often concern about whether there is enough x to meet new demand in y,” says first author Elsa Olivetti, a materials scientist at the Massachusetts Institute of Technology. “You end up with a lot of hype without thoughtful care about where the challenges are, so let’s panic where it’s appropriate.”

Lithium-ion batteries are increasingly attractive for electric cars because they are lightweight, powerful, and rechargeable. Like all batteries, lithium-ion batteries consist of an anode (typically graphite), a cathode (typically oxides of lithium, cobalt, nickel, and/or manganese), and a liquid electrolyte to transport the charge (a solution of lithium and other ions).

Based on publicly available data, the researchers assessed the availability of each of these elements and found cobalt to be most vulnerable to potential supply chain issues. Lithium is less of a concern because, even though the demand will significantly increase in the near future, it can be mined from a variety of sources, including rock and sea brine, and is abundant in several countries including Australia, Chile, and Argentina. The majority of cobalt is mined from the Democratic Republic of Congo, which introduces geo-political and supply chain disruption potential. Cobalt is currently economical to recycle, however, and this could help increase its long-term availability.

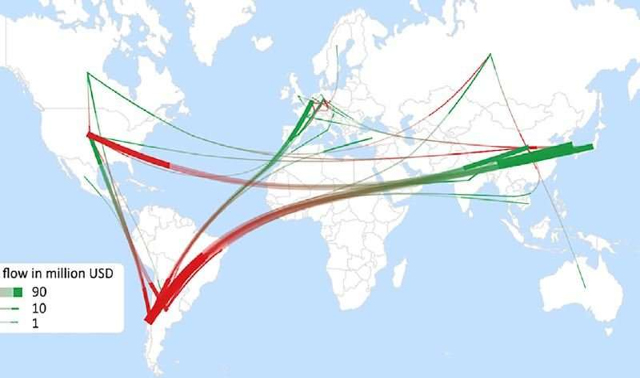

This map shows the aggregated flows of lithium oxide and hydroxide as well as lithium carbonates (does not include concentrates, which would be dominated by Australia). Flows below 1 million USD in value are not included. Credit: Olivetti et al./Joule 2017

“Today, less than 1% of the automotive sector has any level of electrification, and almost half of Li-ion batteries are already going towards the automotive field. So we see that there’s going to be an enormous push on some of the essential resources,” says co-author Gerbrand Ceder, of the Department of Materials Science & Engineering at the University of California, Berkeley. “We wrote this paper so people don’t think, ‘oh if I run out of cobalt, I’ll just switch to something else.’ There are real resource issues on the horizon that the industry can start planning for and avoid.”

The researchers predict that supply and demand for cobalt may become unbalanced by 2025, but they suggest two longer-term strategies to handle the demand for the metal—enhancing recycling and developing new technologies. Cobalt is so attractive for lithium-ion batteries because the element creates stable cathode materials. Non-cobalt-containing cathodes have not been able to rival the cobalt-based cathodes, but recent studies have demonstrated that other cathode compounds with other metals, such as manganese, molybdenum, titanium or chromium, could act as substitutes.

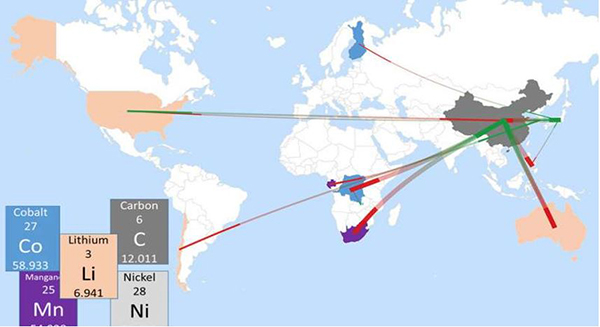

A new analysis indicates that, without proper planning, there could be short-term bottlenecks in the supplies of some metals, particularly lithium and cobalt, that could cause temporary slowdowns in lithium-ion battery production. This map shows today’s trade flows of key ingredients for battery production, with exports from each country shown in red and imports in green. Credit: MIT

One limitation of the study is that it is static and does not take into account world events such as hurricanes or wars that would almost certainly impact battery supplies. Whether supply can meet demand also depends on how the markets will react to increases or decreases in resource availability.

“Making predictions is hard, but I do think that there’s information within the paper that will educate all of us.” Ceder says. Olivetti adds: “We want to make sure that everyone is thinking about these issues, and that we have the right solution for whatever time on the horizon we’re planning for.”

Notice: Images and logos is for illustration purposes only and not intended for patent infringement